I’ve been following the $DONUTS experiment on the r/ethtrader subreddit for a while now. At a high level, it’s actually doing in production many things we imagine communities doing with SourceCred: minting crypto (ERC-20 tokens) based on reputation scores (in this case a function of Reddit karma), using those tokens for community governance (DONUT-weighted Reddit polls and Aragon DAO votes) and generating revenue (e.g. you can buy the sub’s banner ad space using a Harberger Tax). It’s also doing so at scale (238k subscribers), has active engagement from a growing subset of users, and has a market on Uniswap that, while relatively small, is now liquid enough for contributors to sell for USD if they want. It has also faced some controversy and backlash from parts of the community, something SourceCred will likely also see in more established communities. So I thought it time for a deeper dive into the DONUTS.

In this post, I provide a brief history of the project, describe the basic DONUTS tokenomics and governance, show some relevant stats I gathered, and reflect on my personal experience as a contributor – I was part of the original airdrop of tokens, got a few due DONUTS from a handful of comments I’ve made in the past, and have sold some on Uniswap.

I plan on posting this to r/ethtrader, getting some DONUTS for it, estimating the value of those tokens, and posting it here.

History

Fun fact, @cslarson (head moderator of r/ethtrader and founder of DONUTS as far as I can tell) was actually hacking on SourceCred before DONUTS happened. He, along with @lkngtn and @jvluso had recently coded up credao at a hackathon, a project that mints ERC-20 tokens in an Aragon DAO according to Cred scores, when he got the call from Reddit offering support for prototyping DONUTS on r/ethtrader. Can’t blame him:)

The introduction of DONUTS around 11 months ago was controversial. Some were enthusiastic about tokenizing karma, while others were vehemently opposed. This split eventually resulted in much drama and 6/10 of the sub’s mods leaving , with those opposing leaving and creating their own sub, r/ethfinance (19.8k subscribers currently, compared to r/ethtrader’s 238k). SourceCred has imagined this dynamic potentially appearing when introduced to communities, especially in more mature communities with established power structures.

r/ethtrader engagement seemed to drop off in the wake of the split, but activity continued to be comparable to other crypto subreddits (my totally unscientific impression based on popping in now and then). Lately, with the rise of DeFi, Reddit introducing community points (Reddit is looking to roll this out to more subreddits if successful), and general bull market excitement, engagement seems to have picked up, with people generally excited about DONUTS.

After an intial burst of low-volume trading activity, the market died down until a couple months ago, when the price of DONUTS spiked. Since then the token has showed signs of life, seen increasing volume and liquidity, and recently garnered a listing on CoinGeko.. Market cap as of time of writing is ~$175k.

This is very interesting I think, as the “long tail” of communities using SourceCred may have similarly small and illiquid markets, only feasible using Automated Market Makers (AMM) such as Uniswap, Bancor, etc. Is $175k mcap and $37,629 in the liquidity pool (current amount) enough for contributors regularly cashing out to pay rent?

Tokenomics

Like in SourceCred’s internal Credsperiment, there are two tokens, one a non-transferrable reputation token (CONTRIB) and a tradable token (DONUTS). Voting on governance decisions, such as whether to change the issuance rate of DONUTS, is done via a function of CONTRIB and DONUTS. Vote power per contributor is calculated as: min(CONTRIB, DONUT). 1 CONTRIB = 1 DONUT. So, if you sell DONUTS you have less voting power than those who HODL. This also keeps people from simply buying up DONUTS to sway votes. Note that these equations may have shifted.

Tokens are minted and managed in an Aragon DAO. Tokens are distributed weekly based on the following formula:

- 5% for moderators

- 95% for posts and comments (proportional to karma)

I find it interesting that SourceCred has also converged on ~5% as a reasonable “tax/royality/service fee/tribute” from projects using it.

Governance

Token distributions are first posted to r/ethtrader in the form of a CSV, where contributors can comment. The latest one just went up,

DONUTS distribution across contributors looks like a typical power law distribution seen generally in subreddits…

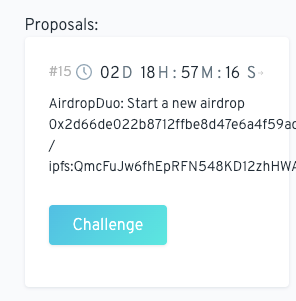

The proposed distribution is then submitted as a proposed airdrop in the Aragon DAO using the AirdropDuo app, where token holders can vote to challenge (block) the distribution.

If the airdrop isn’t challenged, tokens are sent to the ETH addresses of contributors that have registered their address with Reddit.

Any community member can propose changes to the system. First by submitting a “Poll proposal post” to gauge sentiment. Then, if there’s support for the idea, there is a token-weighted Reddit poll. For example, here’s a recent poll where the community voted on a “DONUT halvening” which cut the new DONUT and CONTRIB issuance in half from 2m to 1m new DONUTs and CONTRIBs per week.

This is very interesting for SourceCred, as governance surrounding the issuance rate of Grain is still an open challenge. This seems like a relatively simple way for the community to negotiate issuance. So far votes have seemed relatively drama free.

Selling DONUTS

During the %900 price spike a couple months ago, i couldn’t help but sell most of my DONUTS for DAI.

I have to say, getting paid on-chain for content I created on Reddit was a quite thrilling experience for me. Very validating of the future we’re creating.

Today when I checked the DAO for new airdrops, I had four waiting for me.

Unfortunately, with an estimated gas fee of $4.07, 3/4 of the airdrops were worth less than the estimated gas to claim them. So I just claimed the 25,295 token drop for $45.08, minus $4.07 in gas = $41.73. Not bad for some snarky Reddit comments

The liquidity pool looks like it’s growing.

The price is up %16 in the last 24 hrs

This brings up another interesting issue. While SourceCred’s Grain token is going to be pegged 1:1 to the USD for the forseeable future, other projects that use it are going to just open a market on Uniswap, add some liquidity, and likely see price volatility. Will contributors need to become amateur traders? Learn about Uniswap, liquidity pools, potential politics around moving the price? The r/ethtrader community of course knows all this, but will your standard OSS contributor? Will they want this abstracted? Will that potentially rob people of upside if the coin moons?

I for one am enjoying the fact that my posts are collecting growing streams of crypto tokens

.

.